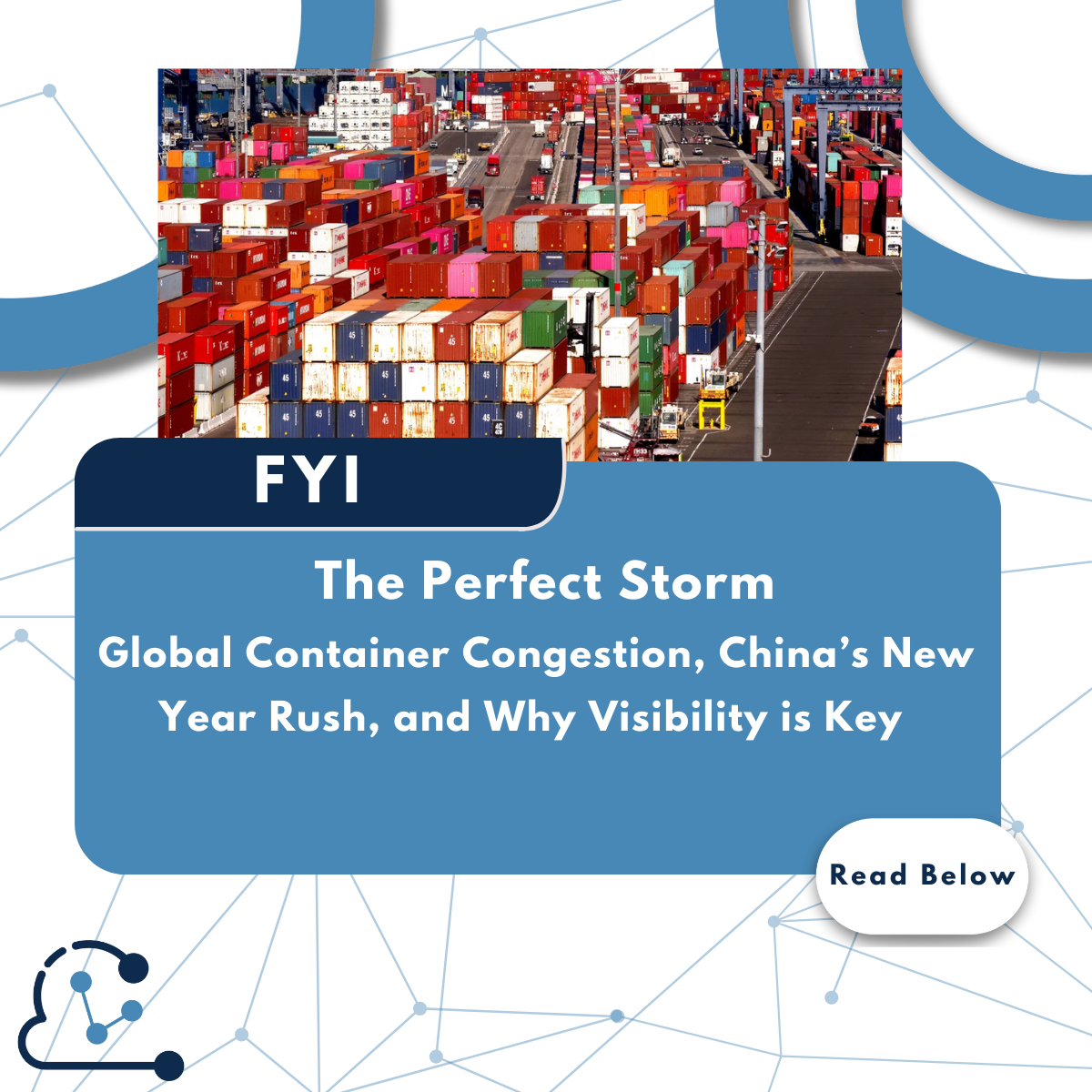

It’s the logistics equivalent of the perfect storm: Chinese factories are racing to ship goods before the New Year holiday. Add in the looming spectre of US import tariffs and some nasty winter weather, and you’ve got container ports across Asia, Europe, and North America at a breaking point.

According to Linerlytica, global port congestion has hit a three-month high, with an estimated 3.3 million TEU – nearly 11% of the global container fleet – stuck at ports. China’s Yangtze River and Pearl River Delta ports are experiencing unprecedented congestion. Why? A surge of cargo trying to beat the holiday lull and potential tariffs on Chinese imports to the US.

Take Yantian, for example. This southern port, responsible for a third of Guangdong’s international trade and 25% of China’s exports to the US, has increased its daily cap on container handling by 15%, up to 15,000 units per day. In 2024, Yantian hit record volumes of 17.37 million TEU, reflecting a 7% year-on-year increase, while neighbouring Shenzhen saw exports climb 15% to a staggering CNY2.81 trillion (£303 billion).

But it’s not just China. Severe weather across the US Atlantic coast and English Channel is delaying vessels. UK ports like Felixstowe, Southampton, and London Gateway have all faced closures, while industrial action in French ports and at ECT Rotterdam is adding to the chaos.

The Bigger Picture: Visibility and the Climate Connection

Here’s the kicker: this isn’t just a logistical headache; it’s a data problem. Businesses – especially BCOs (Beneficial Cargo Owners) and LSPs (Logistics Service Providers) – are flying blind without real-time supply chain visibility. The lack of accurate data means critical decisions are being made in the dark.

Imagine the power of a dashboard that not only tracks shipments in real time but also layers in climate impact insights. How would that change your strategy? What if you could anticipate disruptions like pre-holiday rushes, tariffs, or weather delays, and proactively re-route cargo or manage inventory?

This isn’t a fantasy. Supply chain visibility software is the next frontier for logistics, helping businesses not only adapt to disruptions but also minimise their environmental impact. With container fleets jammed at ports and emissions ticking up, the need for actionable data has never been clearer.

The takeaway? The supply chain industry is overdue for a digital transformation. Those who embrace it will thrive. Those who don’t? They’ll drown in the perfect storm.